During our parents and grandparents’ generation, the experience of buying a car, a house or even clothes and food was totally different from how we (our generation) makes a purchase. Why? Because they lived on the principle of “if we do not have it, we can’t get it” and “we’re not going to get it, until we have the money for it.” And for them “having the money for it” meant “having the cash for it”. They paid cash for everything. Loans and credit cards were relatively taboo in those days and most of them were steadfast on living within their means. Fast forward to 2015 and we have credit cards falling out of our wallets. We use it for everything—from buying the new “Red bottoms” as Saks Fifth Avenue to getting a Big Mac at McDonalds. We use it even when we have the cash to purchase it.

[featured-image]

Courtesy of dollarphotoclub.com

Now, unlike many financial gurus, I do not believe in completely getting rid of ALL credit cards (read next week’s blog). I believe that if you are responsible and have self-control, you should have ONE credit card for travel (purchasing flights, renting cars, paying for hotels). The problem is, we get tons of credit cards, use it for EVERYTHING, get in all types of debt, cannot pay the debt (or any of the other expenses we have) and take a hit (or multiple hits) to our credit report; thereby, obtaining bad credit.

Being irresponsible with debt causes years of damage and have long lasting effects that could take years to remedy. And in 2015, having “good credit” matters because it affects our ability to have some of your basic needs met. In short, it impacts:

- Our ability to obtain utility. Utility companies check credit. If we have bad credit, many will make us put a reserve or down-payment on our account prior to turning on the electricity, gas or water. No reserve, no utility.

- Our ability to obtain housing. Not only do mortgage lenders check credit, but landlords check credit as well. My husband and I are landlords and credit checks are a part of our rental application. If an applicant has bad credit, how are they going to pay my rent, when they cannot even pay their water bill?

- Our ability to obtain employment. More and more companies are jumping on the “credit check” bandwagon before hiring employees. I have personally known people get hired for a job “pending” credit check, and get a call back saying they were not going to get hired because of their credit.

So what can you do to begin getting your credit back in shape if it is “out-of-shape”?

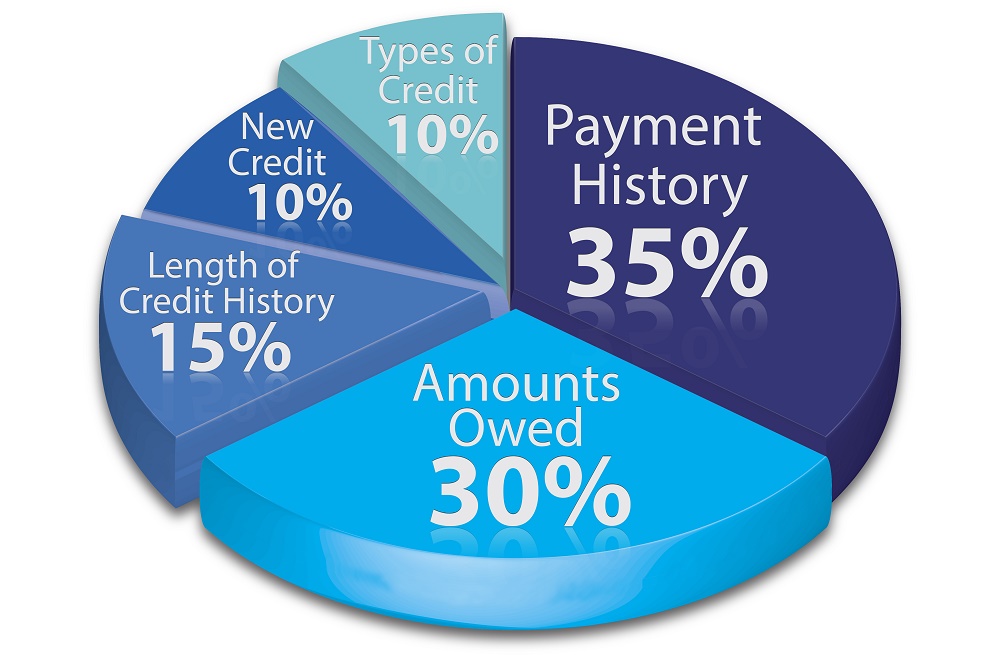

Step 1: Pay off your debts. Thirty percent of your credit score is based off your debt. So if you spent it, pay it.

Step 2: Pay your bills on-time. In paying off your debt, make sure you are paying each on-time, every month including those bills those bills that will never go away (i.e. water bill, electricity bill). Payment History represents 35% of your credit score calculation, so pay on-time!

Step 3: Stop opening up credit cards to get the 20% discount and then closing them. It hurts your credit score. Length of credit History is worth 15% of your score.

Again, your credit really does matter. It now has a lasting effect on almost every area of our lives, especially if we are not being good managers of it.

How has credit impacted your life? Share this blog or leave a comment.

To get more information on personal finance, subscribe to our blog below and download our FREE CHEAT SHEET, “7 Steps to Building a Financial Legacy”.