The best way to succeed in anything is to first, believe. Believe you can do it, believe you will do it and believe in the plan to getting it done. Yes, planning your way to success is the recipe to actually acquiring the success you desire. This holds true in every area of our lives, be it relationships, careers, parenting and even in our finances.

[featured-image]

Courtesy of dollarphotoclub.com

Successful people do not just fall into success. They are very intentional and goal oriented; they set high standards and do everything in their power to meet or exceed their goals.

If we can plan our weekends, family vacations, or even what we will wear to work for the week, then certainly, we can put that much time and effort in planning how successful we will be in our finances.

Someone once said, “show me a man who fails to plan, and I will show you a man who will never succeed in life” (Unknown).

If you are like me, I want to be successful in every aspect of my life–including my finances. That is why my husband and I set annual financial goals (what we will pay off, how much we will save, etc…) and create our monthly budget to align with those goals.

Statistics say, “43% of Americans spend more than (they) earn (each month)” (Bureau of Economic Analysis). So to ensure we are not a part of the statistics, we plan and try our best to follow the plan. Why? Because when there is not a set goal, standard or objective, we all tend to spend our money frivolously. As long as there is money in the bank, we can spend (so we think). The problem is, without a “plan”, the following tends to happen:

U.S. household consumer debt profile:

- Average credit card debt: $15,609

- Average mortgage debt: $156,706

- Average student loan debt: $32,956

(Source: Nerdwallet.com)

DEBT

DEBT

AND MORE DEBT

So the best way to not overspend (or get into more debt) is to create monthly budgets at least one month prior to spending. Here’s how:

- Write out your monthly household income. If you are married and pay bills together, add your spouse’s income in as well. Note: Make sure you are factoring in the NET INCOME, not your GROSS. Net Income is what you actually bring home (what is deposited into your account).

- List out all of your monthly expenses. Write it all out. Even factor in weekly (or daily) trips to Starbucks. Make sure you include all your expenses (house note, car note, insurances, gas, groceries, clothing, utilities, etc…)

- Subtract your monthly expenses from your monthly household income. See equation below.

= Monthly Household income – Monthly Expenses

If your expenses is more than your income, determine where you can cut back or eliminate a bill.

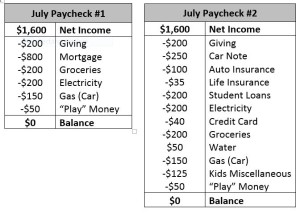

- Create a monthly budget by assigning an expense to a paycheck. Every dollar in your budget must be assigned to something. See the Example below.

5. Stick to the budget. Of course, things may come up like your child needing something for school at the last minute, so just adjust your budget accordingly. But by all means, write out a monthly plan/budget (like the one above). And when you get paid, before you spend a dime, pull out your budget and spend according to the plan.

5. Stick to the budget. Of course, things may come up like your child needing something for school at the last minute, so just adjust your budget accordingly. But by all means, write out a monthly plan/budget (like the one above). And when you get paid, before you spend a dime, pull out your budget and spend according to the plan.

These are the steps that we use to take control of our finances and plan our way to success. What budgeting tips do you use?

To get more tips on succeeding in your personal finances, subscribe to our blog below and download our FREE CHEAT SHEET, “7 Steps to Building a Financial Legacy”.