Nearly two out of three Americans do not have spending plan or some means of tracking their monthly expenditures, according to a Gallup report. That’s nearly 70% which is eerily close to the percent of American families who do not have at least $1,000 saved. See the correlation? It’s difficult to save for a rainy day, get ahead on bills, pay off debt, or even invest in your future when there is no plan in place. Zig Ziglar even states, “When you aim at nothing, you hit it every time.”

[featured-image]

I know this statement to be true in my own life. When I do not have an exercise plan, it is so easy for me to gain weight. Why? Because I do not have any parameters surrounding my eating habits or physical activities. The same rings true for our finances! When we go through our financial life haphazardly, it is so easy to end up in a place we never expected; thereby, failing to plan only leads to planning to fail.

So, in order to have financial success, we all must create a strategy—a financial strategy. We need to “tell our money where to go, instead of wondering where it went” (Dave Ramsey). So here are three tips to follow that will help you create a successful spending plan.

#1 Pay your bills based on your paycheck dates

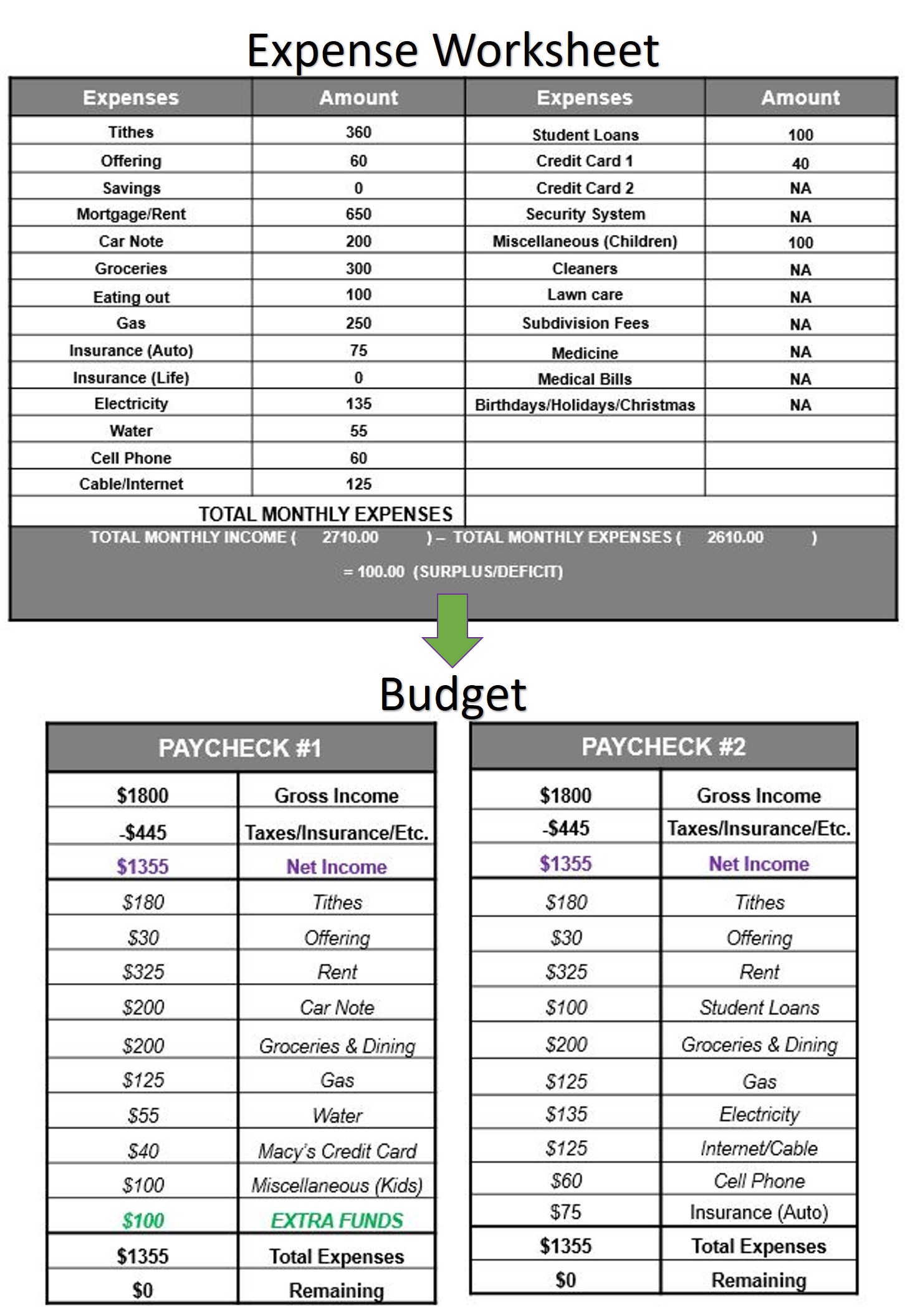

If you read the previous blog, you have already written out all of your expenses and determined where you could reduce or eliminate one or more of your monthly expenses (To Read Click Here). Next, you have to assign every dollar of each paycheck to a bill; therefore, if you are paid twice a month (i.e. on the 15th and 31st), based on when your bills are due, determine which paycheck will cover each bill. If your pay dates and your bill dates do not coincide, call the company and see if you can change when the bill is due. Most companies will work with you when it comes to due dates. See an example below.

#2 Any funds leftover from each check must be assigned to a financial goal

In looking at the above example, after paying all of their bills each month, this person has $100 leftover (as shown in their expense sheet as well as their paycheck #1). So, if you do not have at least $1,000 in your Emergency Fund, saving should be your first financial goal. In this case, $100 should be deposited in their Emergency Savings Account until they reach $1,000. Since we have a family of five, we saved a little more. For your family, determine how much you would need if you had to pay a medical deductible, a new transmission or any type of unexpected expense.

If you already have a good cushion in your Emergency Fund, assign the extra money to one debt. Don’t spread the $100 over several debts, put it all on one debt. List out your debts smallest to largest and put the extra $100 to the smallest debt. Once the smallest debt is paid off, put the extra on the next debt and so on until each debt is paid off (except your mortgage).

So in the case above, the smallest debt is their Macy’s bill ($550), then their car loan ($7,500) and lastly their student loan ($15,000). So, if this person uses this method, they would pay $140 on their Macy’s bill from their first paycheck ($40 minimum plus the $100 extra) and after four months, Macy’s is paid off. Next, they will take that $140 they were putting on their Macy’s bill and add it to their car note. So, instead of paying $200 per month, they are now paying $340 ($200 plus $140). If they stay consistent in paying this amount on their car, they would be able to pay their car note off nearly one year earlier. And after the car note is paid off, they’d take the $340 and add it to the $100 they were paying on their student loan. Now, instead of taking 10+ years to pay off their student loans, by paying $440 each, it will only take about three years (not including interests).

I call this the “Trickle Down Method” because after one debt is paid off, all of the money “trickle downs” to the next debt. Dave Ramsey calls it the “Snow-Ball Method”. Whatever you call it, the method works!

#3 Pay your bills the day you get paid

What I know for sure is if I keep money in the account meaning to pay bills later, the money in the account will inevitably end up being spent on something else. So, what helped us tremendously in paying down debt is learning to PAY OUR BILLS THE DAY WE GET PAID. Now, this may mean, after you have taken out grocery money or eating out money (pull the cash out), you may not have ANY money in your account the next day; however, if you budgeted well, this will work. Why? Because…

It forces you not to overspend (no money in the account).

If you use cash for your groceries or eating out, you will not spend as much (don’t want to get to the cash register and not have enough cash or no money in the account)

Makes you keener on what you are spending. If you have taken out your “eating out” money on the first paycheck, you will not eat out as much because you know you have to stretch the money until the next paycheck.

These three tips helped us pay off $40,000 of debt, fund our Emergency Savings and helped us organize our financial life in a short amount of time. And just like it worked for us, it can work for you too. One quick tip is to make sure you do not go “cold turkey” on reducing or eliminating expenses, particularly if you need a little help in the discipline arena (like me). You know what happens when you go “cold turkey” and say you will not eat any sweets for the next three months so you can lose weight, right? It just so happens that a slither of chocolate icing enters your mouth (accidentally, of course) and then you end up eating not just the icing, but the entire cake (I’m just a little guilty). So, you now overly indulge in more sweets and thereby, gain not just the weight you loss, but MORE! As it is in our physical health, so it is in our financial health. Going cold turkey does not work!

Therefore, gradually work on digging out of debt. It is a process and the process should be enjoyable (which is something I had to learn). But, if you follow these steps, reduce expenses, create a budget, and use the extra for savings or debt, then your dream of obtaining financial freedom will become your reality. Yes, it may take some time. Our family still has a “ways” to go, but we are one “debt” closer to becoming financially free! And you could be too! So, determine what your target and AIM!

If you like to download our FREE Expense Worksheet as well as our Free Cheat Sheet to Building a Financial Legacy, subscribe below.