This week, 20 years ago, I walked into my Financial Aid Office and signed my name on the dotted line to receive my first piece of debt–STUDENT LOANS. It was then and there that I became part of the American statistic. According to Student Loan Hero’s website,

- $1.26 trillion in total U.S. student loan debt

- 3 million Americans with student loan debt

- Student loan delinquency rate of 11.6%

- Average monthly student loan payment (for borrower aged 20 to 30 years): $351

- Median monthly student loan payment (for borrower aged 20 to 30 years): $203

(Source: https://studentloanhero.com/student-loan-debt-statistics-2016/)

[featured-image]

And these stats only include student loan figures. Generally, Americans save the least and spend the most racking up tens of thousands of dollars of additional debt in credit cards, auto loans, personal loans and others.

Please believe I have had my fair share of spending frivolously, both while in college and after graduating; however, after getting educated about personal finances, I now know the consequences of “emotional spending”; the importance of buying what I need instead of what I want; and learning that “catching it on sale” doesn’t mean I am saving money, it means I am spending money. Through the good and the bad, and maturing financially, we are now on our journey to spending wisely, increasing our household income, saving for a rainy day, and getting out of debt.

So how have we paid off over $27,000 (and counting) in the last 18-months? Well, obviously, I believe in “Turning Your Hobby Into a Side Hustle” as a means to get extra income (which is what we did). But after that, we followed the steps in my “7-Steps to Leaving a Financial Legacy Cheat Sheet”, particularly #5. We tackled One Debt At A Time.

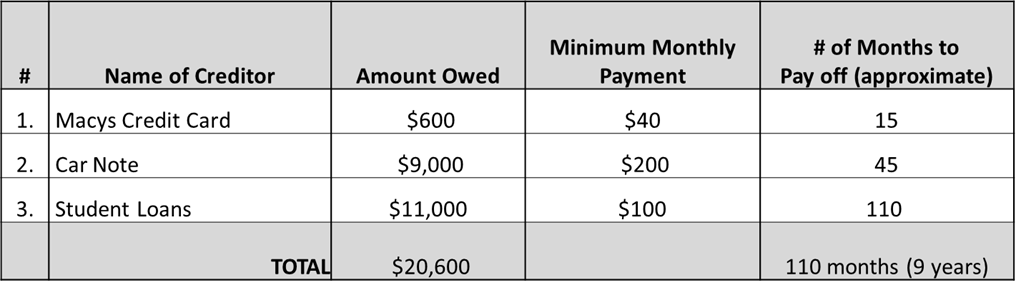

How does it work? First, write down all of your debt from least to greatest and include amount owed and your minimum monthly payments. Divide amount owed by minimum monthly payment to get an approximate number of months it will take you to pay off the debt. Of course, this is an estimate because it does not include interest. For example, if you owe $600 on your Macy’s card and your monthly payment is $40,

$600 / $40 = 15

So, it will take you approximately 15 months to pay off the Macy’s card. Do this for each debt.

If you read Creating a Simple Budget, you know how to assign each dollar a job (i.e. “tell your money where to go instead of wondering where it went”). You also know to take whatever “extra” money you have left after paying yourself and bills and add it to ONE bill. Do not take the extra money and add some to Macy’s, some to your car note and the rest to your student loan. No, focus on ONE DEBT AT A TIME.

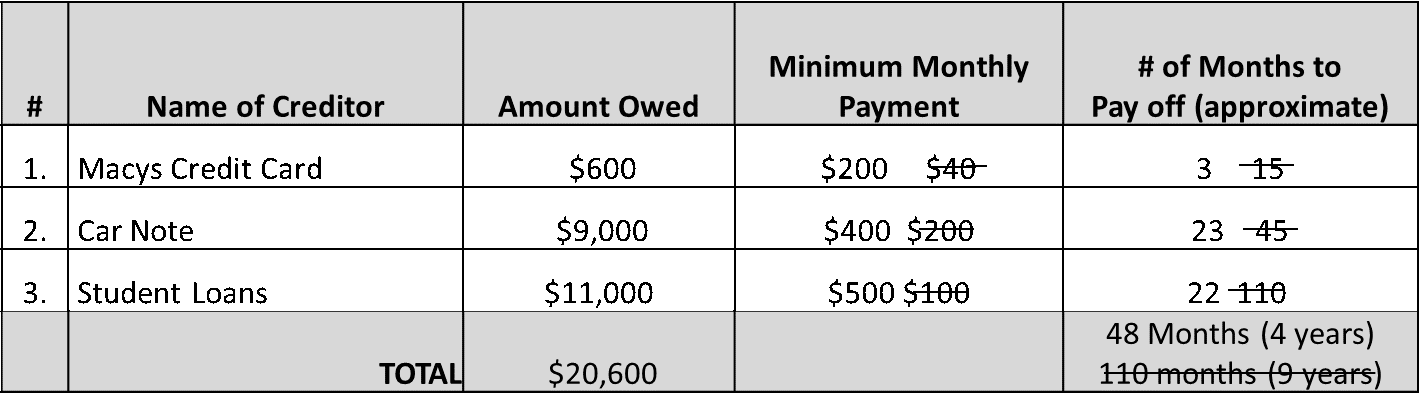

So let’s say you have an additional $160 leftover, take that amount and add it to your monthly Macy’s bill. Now you are paying $200/month on Macy’s ($160 plus the $40 you were already paying). So, instead of it taking 15 months to pay off Macy’s credit card, it will only take you three months.

After you have paid off Macy’s, take that same $200 that you were paying them and add it to your next bill which is your car note. So now you can pay $400 on your car (the $200 you were paying on Macy’s and the $200 you were paying on your car monthly). Instead of it taking 45 months to pay off your car, it will now take you 23 months. Once you have paid off your car note, take that $400 and add it to the $100 you were paying on your student loan. Instead of it taking you nine years to get completely out of debt all pay off ALL bills, it will take you four years. I call this the “Trickle Down Effect”. This method is what we used to pay off over $27,000 worth of debt in 18-months.

Listen, if you are serious about your finances, getting out of debt, and obtaining financial freedom, incorporate this method into your personal finances. You do not have to pay off your bills from least to greatest. If you want to pay off your car note first to free up that $400, do it. Just note, paying off the least amount first helps you gain traction and builds momentum. You are able to quickly benefit from the small wins (in 3-months for your Macy’s bills). Whichever order you decide to pay off your debt, the point is to tackle it ONE DEBT AT A TIME. Let’s do this together and leave something other than bills to our children. Let’s leave a financial legacy!

To help motivate you and get you on your journey, read one of my favorite books on personal finance by Larry Burkett, Debt-Free Living. It details stories of families who accomplished their goals of becoming debt-free. A Must Read.

Update: Since we first posted this blog, we have paid off over $40,000 worth of debt in under two years. Listen to my guest podcast to see how we are Getting Out Of Debt.